How useful are the Seasons models

The Seasons model was made popular by Ray Dalio from Bridgewater Assoc., one of the most successful investors of our times.

The concept we apply is fairly simple:

define 4 macro regimes:

Goldilocks: solid economic growth with little inflation

Reflation: solid economic growth with inflation

Stagflation: stagnant economic growth with inflation

Deflation: stagnant economic growth with little to negative inflation

define appropriate asset allocations/ portfolios that should blossom under each individual regime

Goldilocks:

Long: ['XLB' ,'XLI' , 'NDX' , 'XLY' ] -

Materials, Industrials, Tech, Consumer DiscretionaryShort: ['UUP', 'XLE' , 'XLP' , 'XLU' , 'XLV'] -

US$, Energy, Staples, Utilities, Healthcare

Reflation:

Long: ['RUT' , 'USO', 'XLE', 'XLI', 'NDX' , 'XLY'] -

Small Caps, US OIL, Energy, Industrials, Nasdaq, Consumer DiscretionaryShort: ['UUP', 'XLP' , 'XLU' , 'TLT'] -

US$, Staples, Utilities, 20yr Treasury Bonds

Stagflation:

Long: ['TLT', 'USO' , 'NDX', 'XLU', 'XLE']

Short: ['UUP', 'RUT' , 'XLB', 'XLF' , 'XLP']

Deflation:

Long: ['TLT' , 'GLD' , 'UUP', 'XLP' ,'XLU', 'XLV']

Short: [ 'USO' , 'XLE' , 'XLF', 'XLI', 'NDX']

measure the BARO Indicator aggregate for each portfolio

smooth (3) on quarterly basis to gain a more medium term perspectice

Define a Risk On regime by:

Risk On = Bullish Regimes - Bearish Regimes

= (Goldilocks + Reflation) - (Stagflation + Deflation)

So far the theory, but how does it look in practice….

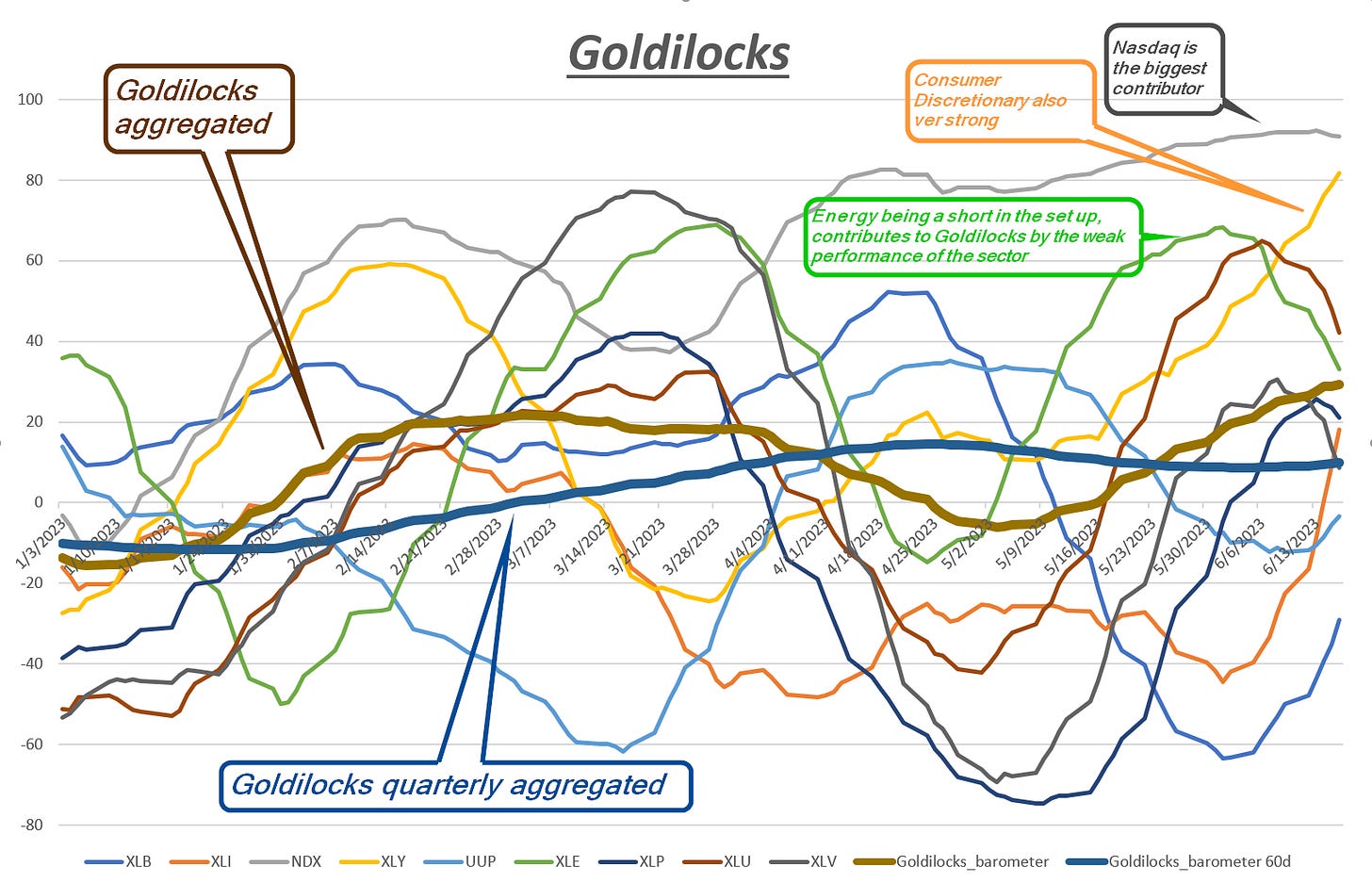

Let’s have a look at the current Goldilocks portfolio:

You can observe how each sector (adjusted for Long or Short) is adding to the overall Goldilocks reading

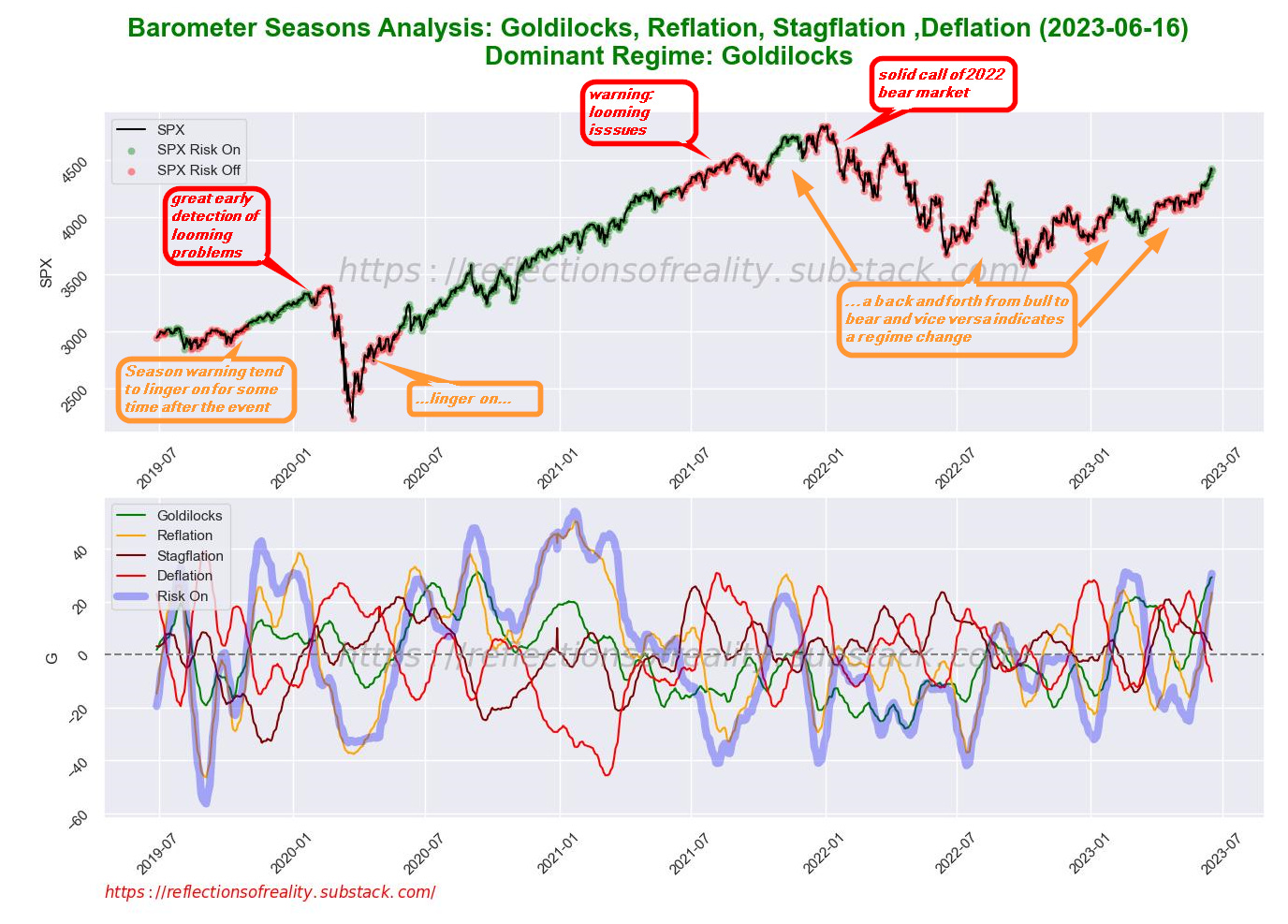

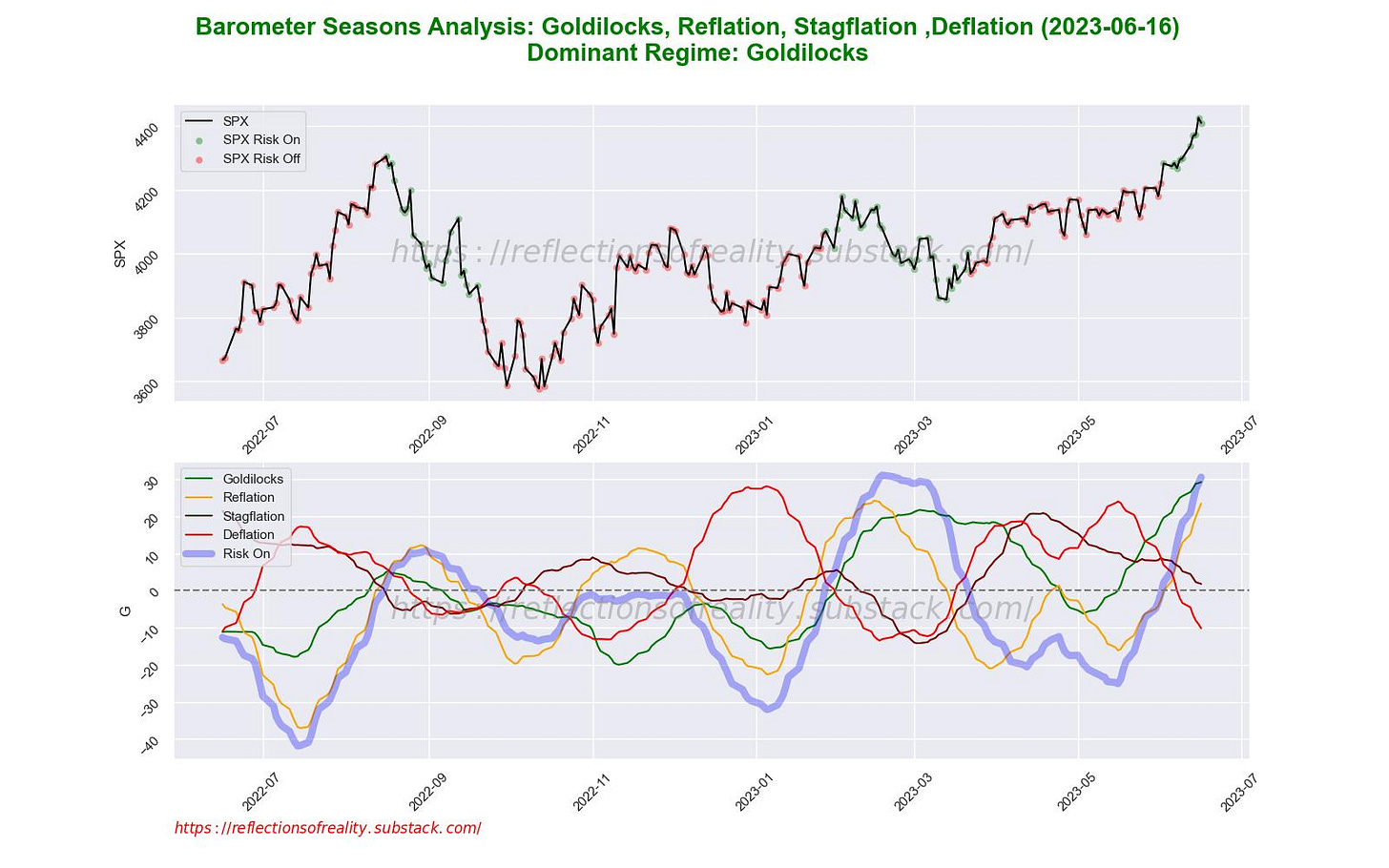

Doing this for all regimes we come up with the following:

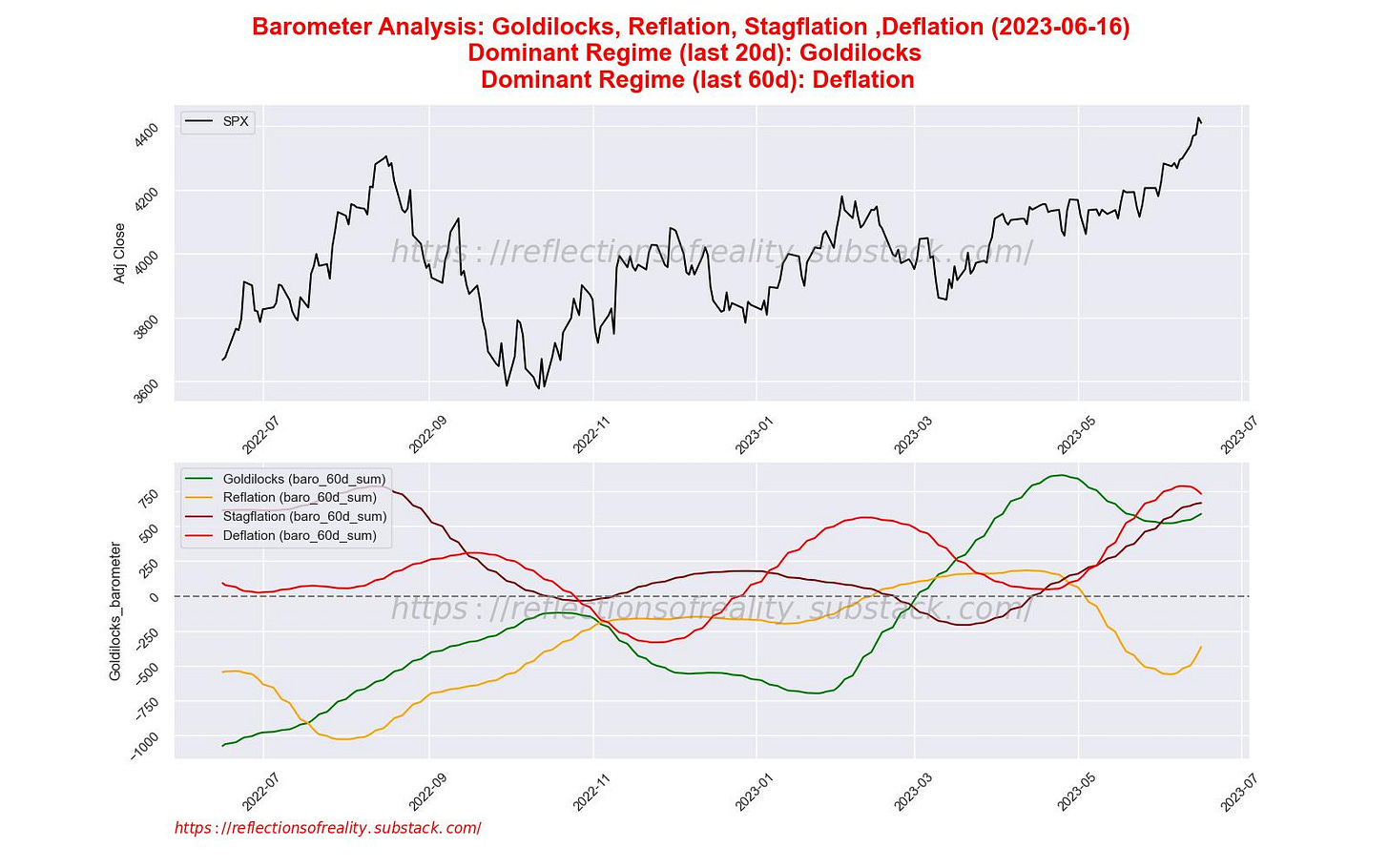

….and for the quarterly analysis:

Interpretation / Application:

The seasons model measure the health of the market by comparing the performance of an idealized portfolio with the current market environment…

if we are in a bull market, than certain sectors have to perform well (and vice versa)

effectively the model gages whether the performance “under the surface” of the main indices has a healthy composition

Characteristics of the model:

keeps you safe from major drawdowns

provides somewhat reliable early warnings

primarily acts as a confirmation and warning tool rather than a perfect market timing tool

Current set up:

we are fading from a dominant deflationary regime (see quarterly analysis) to a Goldilocks set up (see analysis above)

Goldilocks seems to have the hightest momentum

no single regime has prevailed over the last couple of month (flip-flopping) which adds a degree of uncertainty