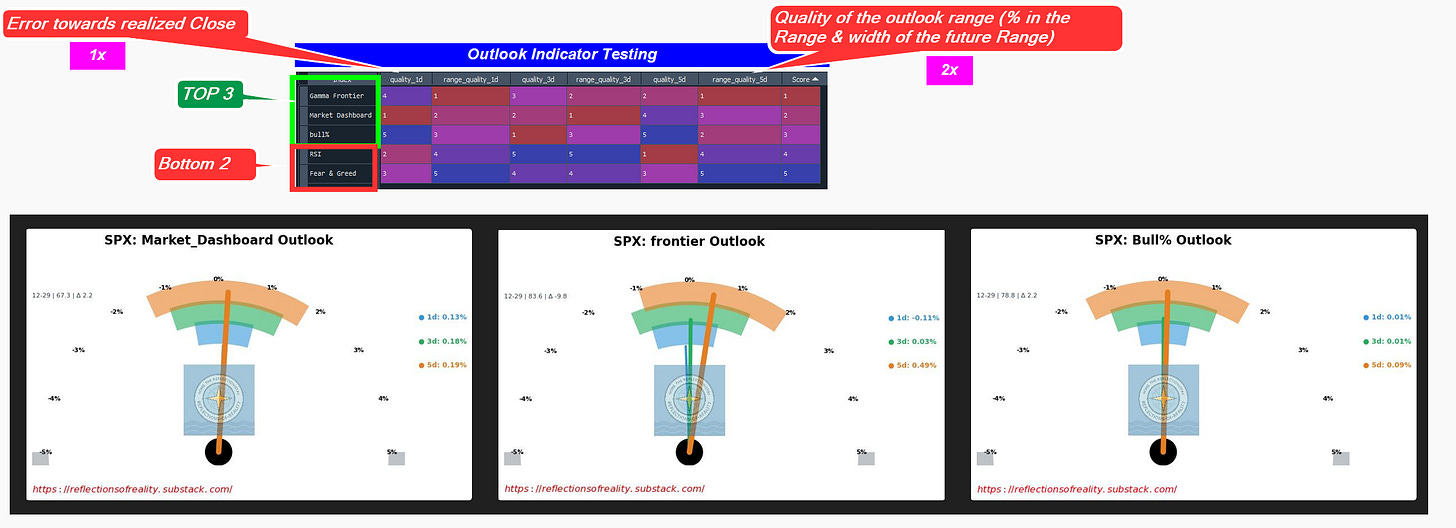

Short-Term Outlook Indicators (1–5 Day Horizon)

Following our post

👉 Introducing the 1–5 Day Bull% Outlook

we took a deeper dive into which indicators exhibit the strongest short-term prognostic power for the S&P 500 over a 1–5 day horizon.

What we tested

We evaluated several indicators across identical forward windows, focusing on two core quality KPIs:

Directional & price accuracy

How close is the forecast to the realized 1-, 3-, and 5-day SPX close?Range quality & volatility projection

How precise is the projected forward range—both in terms of containment (% of outcomes inside the range) and range width?

(Tighter ranges with high containment score higher.)

To provide proper context, we ran the same framework on:

RSI

CNN Fear & Greed Index

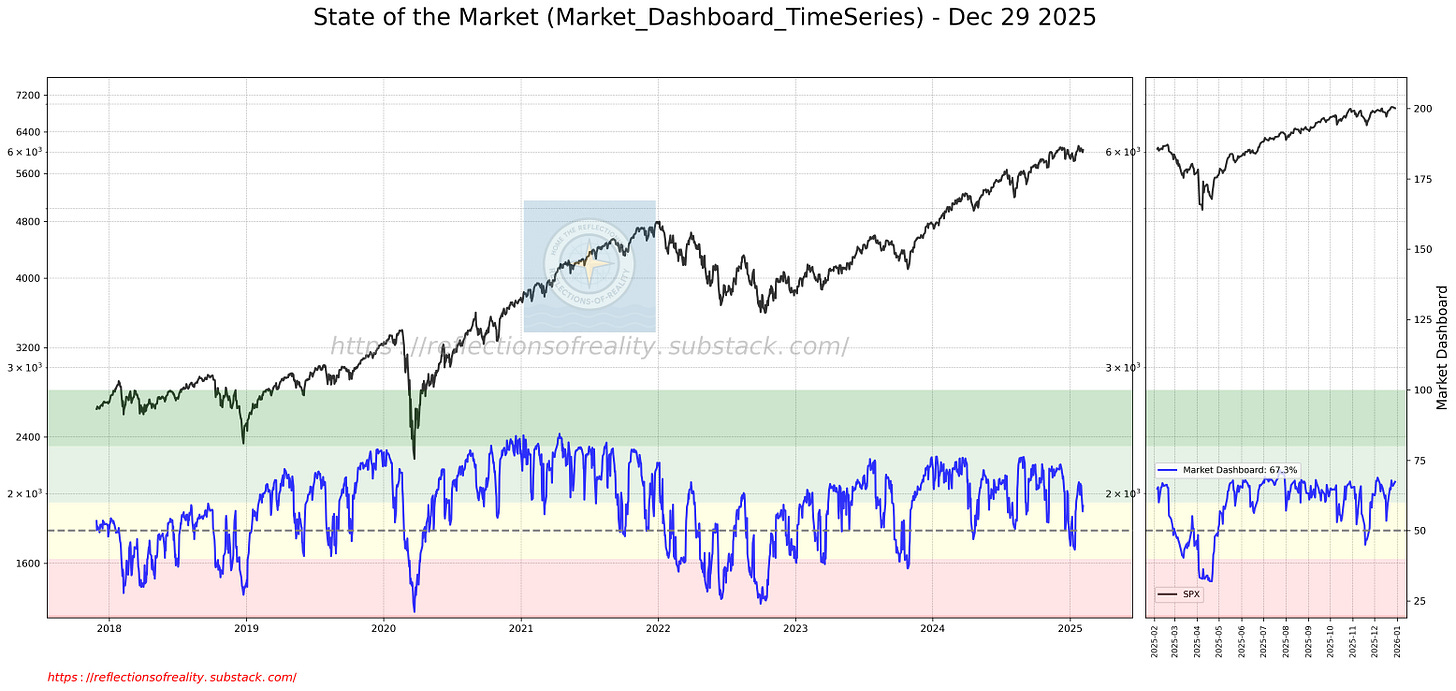

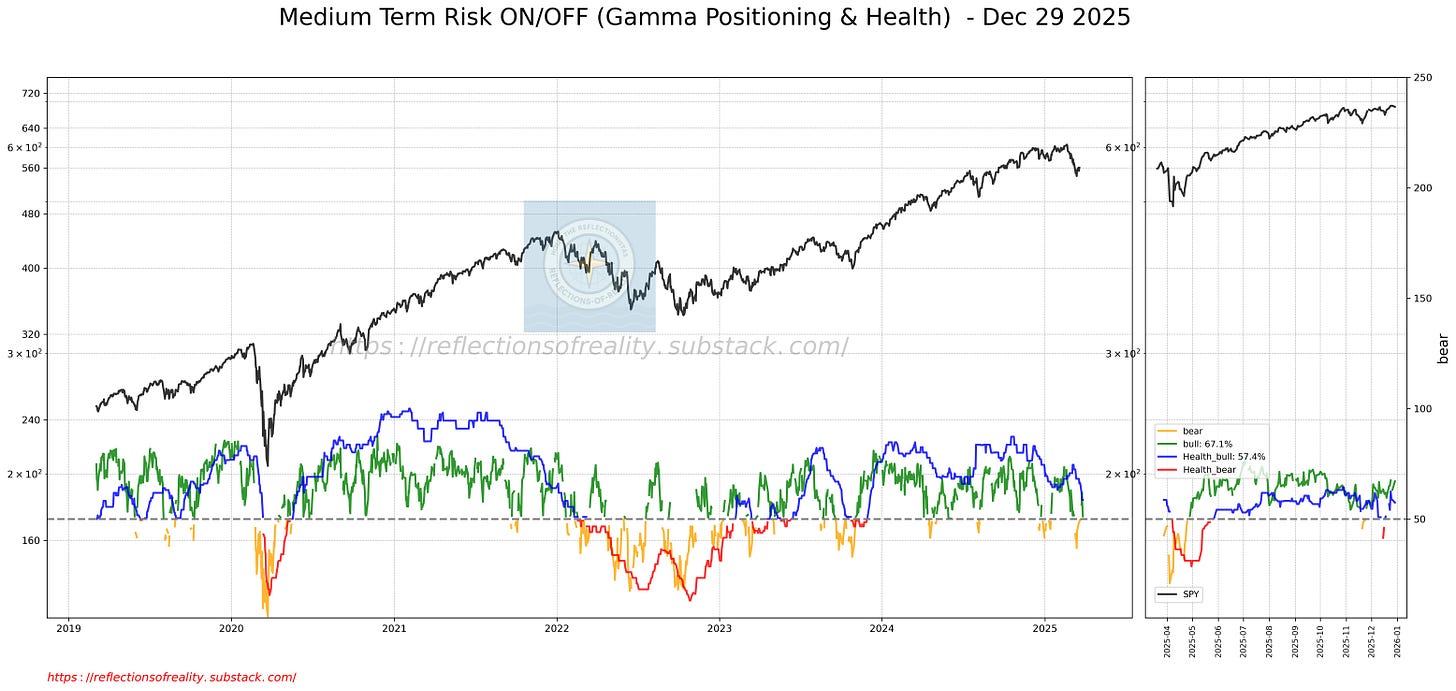

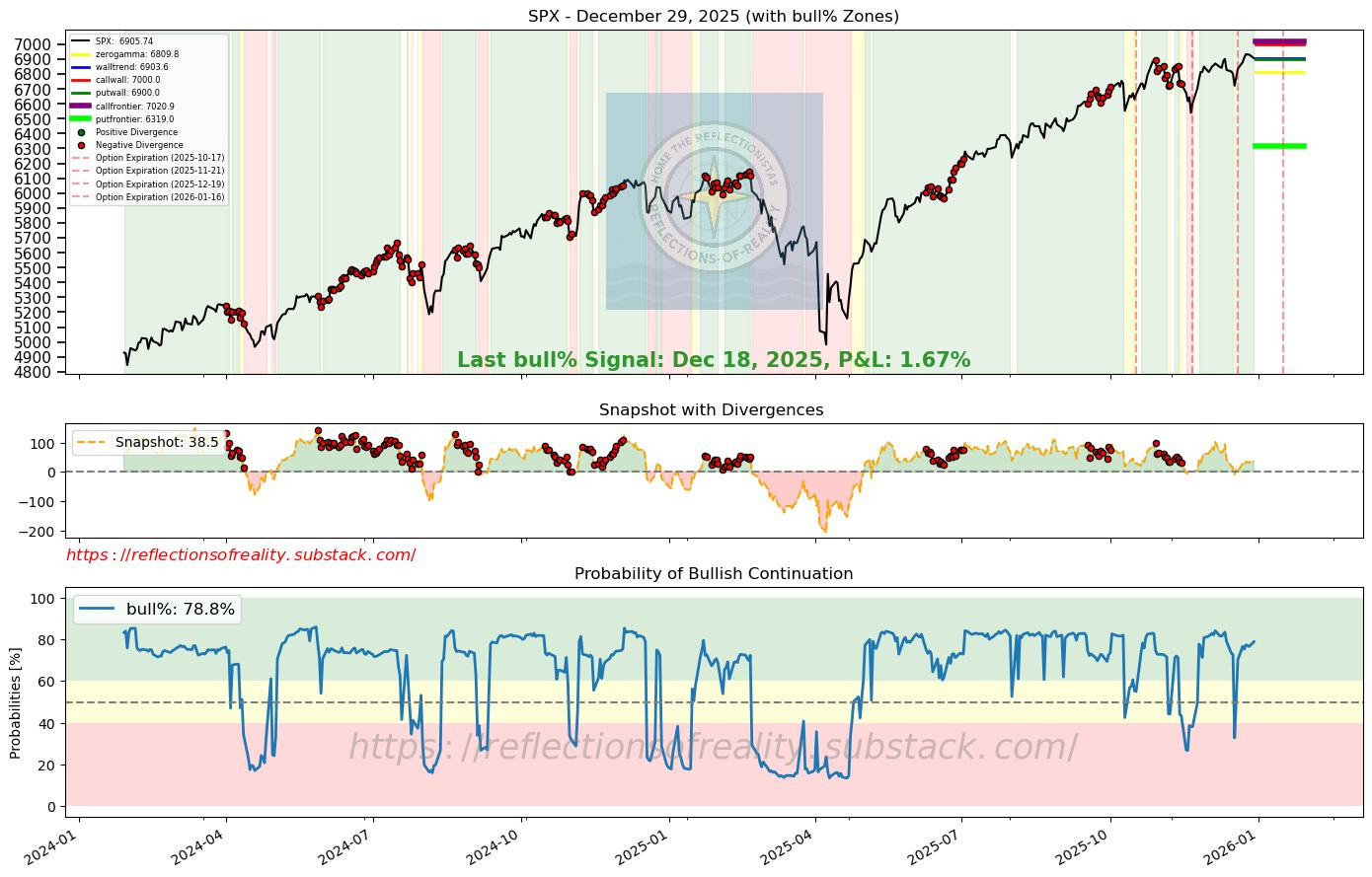

and compared them against our proprietary indicators:

Gamma Frontier

Market Dashboard Index

Bull%

Results at a glance

Top performers:

Gamma Frontier, Market Dashboard Index, and Bull% consistently ranked at the top across both KPIs.Bottom performers:

RSI and CNN Fear & Greed lagged in directional accuracy and overall score.Range behavior:

All indicators produced reasonably tight forward ranges, but our proprietary toolbox showed superior balance between precision and containment.

Conclusion

Our proprietary indicator suite outperforms RSI and CNN Fear & Greed in short-term (1–5 day) SPX forecasting.

All tested indicators generate usable volatility ranges,

Forward focus:

Rather than relying on a single signal, we will increasingly look for multi-indicator alignment to further increase probabilistic edge.