Trend Following "machine learning" style: The All Weather Portfolio

an introduction

I recently got the following question:

What is the easiest, robust long term model with longer holding periods and less trades ?

Answer:

A simple moving average model based on monthly Information bars applied to an All Weather Portfolio.

What are Information Bars?

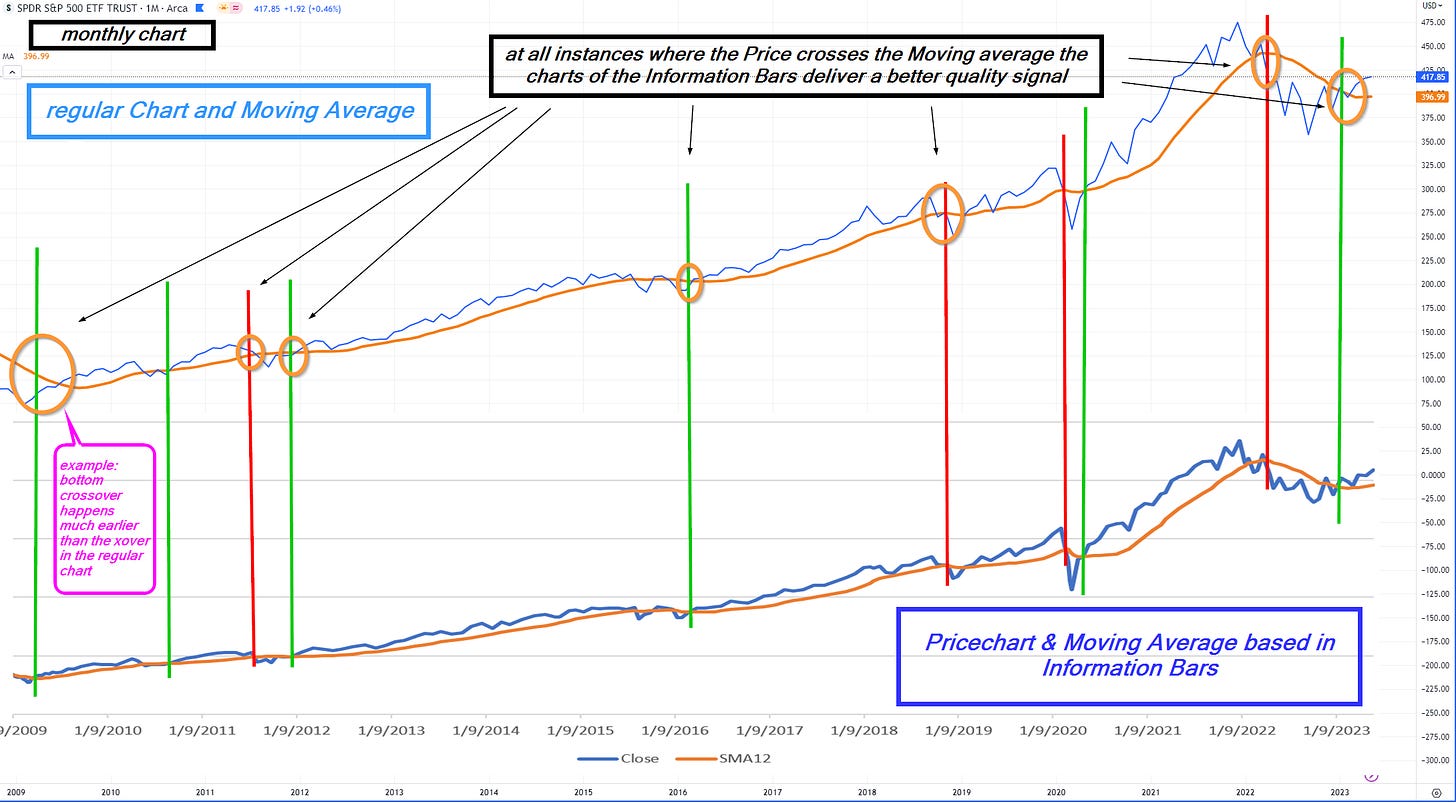

You all know the regular Open, High, Low, Close Charts offered by most websites or charting softwares. For a monthly bar for example you aggregate all trades of a predefined period (1 month) and calculate the respective Open, High, Low, Close (OHLC) values. So the data sampling is based a fixed time period.

If you trade 1 share this trade contains a certain amount of information. If you trade 1000 shares the amount of information is higher than the info gained from trading just 1 share…..

Data sampling by fixed periods (like 1 month) thus result in OHLC bars with varying information contents.

If you now sample ( a favorite concept in machine learning) into bars that all have the same information content you end up with so called Information Bars.

Information Bars contain all the same information but might take longer (in quiet markets) or shorter (in busy markets) to gather the required amount of info. In our example a monthly info bar can take 5-40 days (mostly btw. 15-30 days) to collect the info.

Why using Information bars?

….because they produce better quality charts and moving averages.

See for yourself….

If we now use a simple All Weather portfolio like…

tickers_all_weather =

‘GLD', 'SLV','USO', # Commodities

'XLU', 'XLV', 'XLP', # Defensives

'IEF', 'TLT', 'LQD', # Fixed Income

'UUP', # USD$

'XLY', 'QQQ', 'SMH', # pro- cyclicals…..

'SPY', 'XOP',

‘XLE', 'XLI', 'XLB',

'EFA', # Europe

'BTC-USD' # Bitcoin

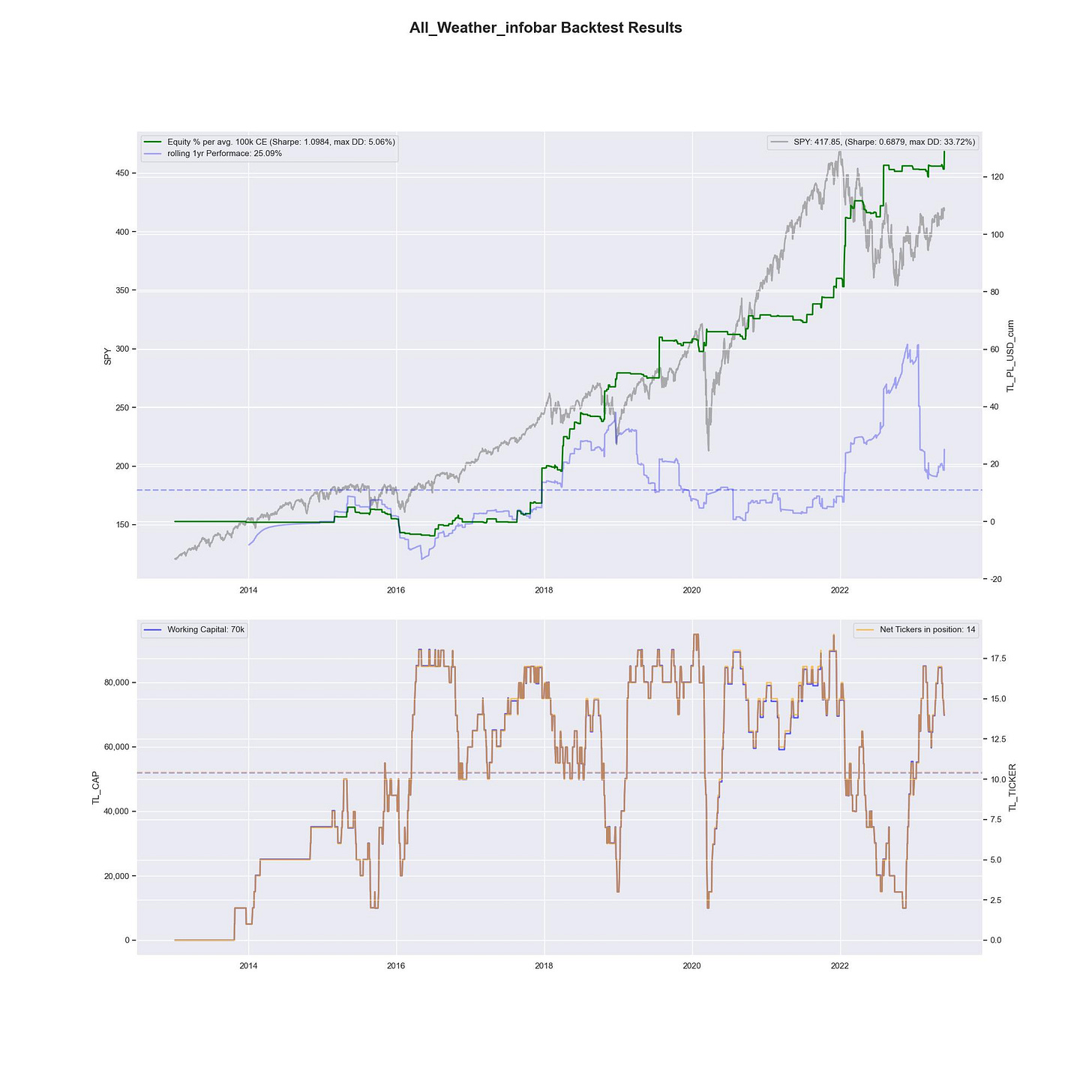

….and use a simply annual moving average model….you get…..

Comments on the result:

the model avoids major drawdowns in your equity

The green equity line aggregates REALIZED P&L only, that means that the curve has occasional jumps where longer term profitable holdings get liquidated. Smaller down movements in the equity curve result from trades that didn’t work out

The hit ratio is just 40%

….but the avg. winner is 4x compared to the avg. looser

holding period can be months/ years

The model catches all major up moves despite the fact that they are less frequent, but when they hit they hit big and overcompensate the 60% loss making trades

The same methodology also works on any random Portfolio like for example the German DAX…