Weekly Trading Update — 27 Dec 2025

New Position Group — 27 Dec 2025

Unlock premium trading signals from our Bull% Framework — subscribe free 👇

https://reflectionsofreality.substack.com/subscribe

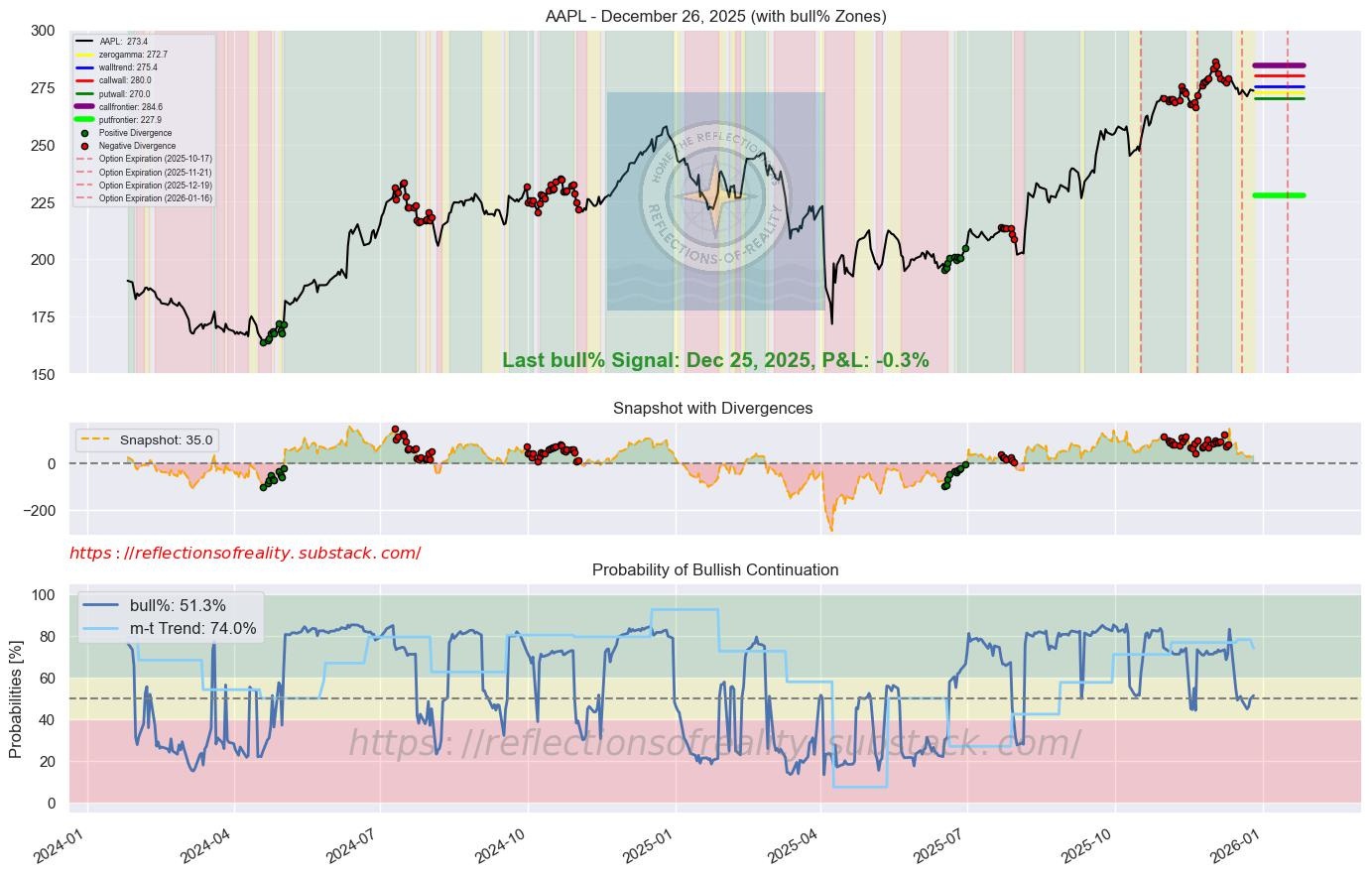

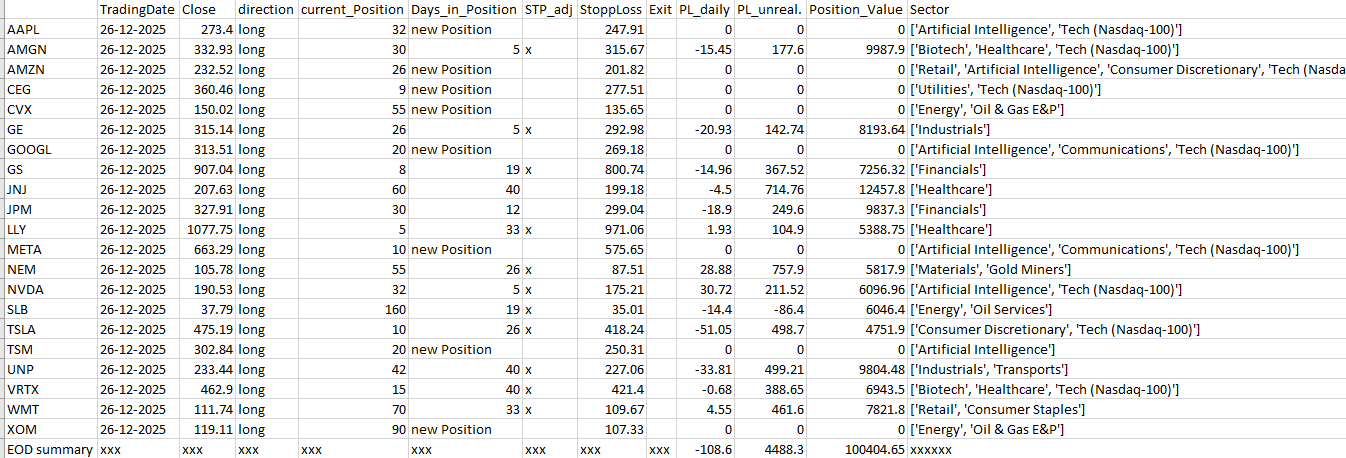

AAPL | 51.3 | +0.9 | [”Beacon1”, “MAGS”] | Apple reclaimed market share in China with a 128% surge in iPhone 17 shipments, driven by strong holiday demand. This performance highlights Apple’s resilient positioning in the premium smartphone segment amid competitive pressures. The gains underscore potential for continued momentum into 2026 as AI features roll out further. (CNBC, 25 Dec 2025)

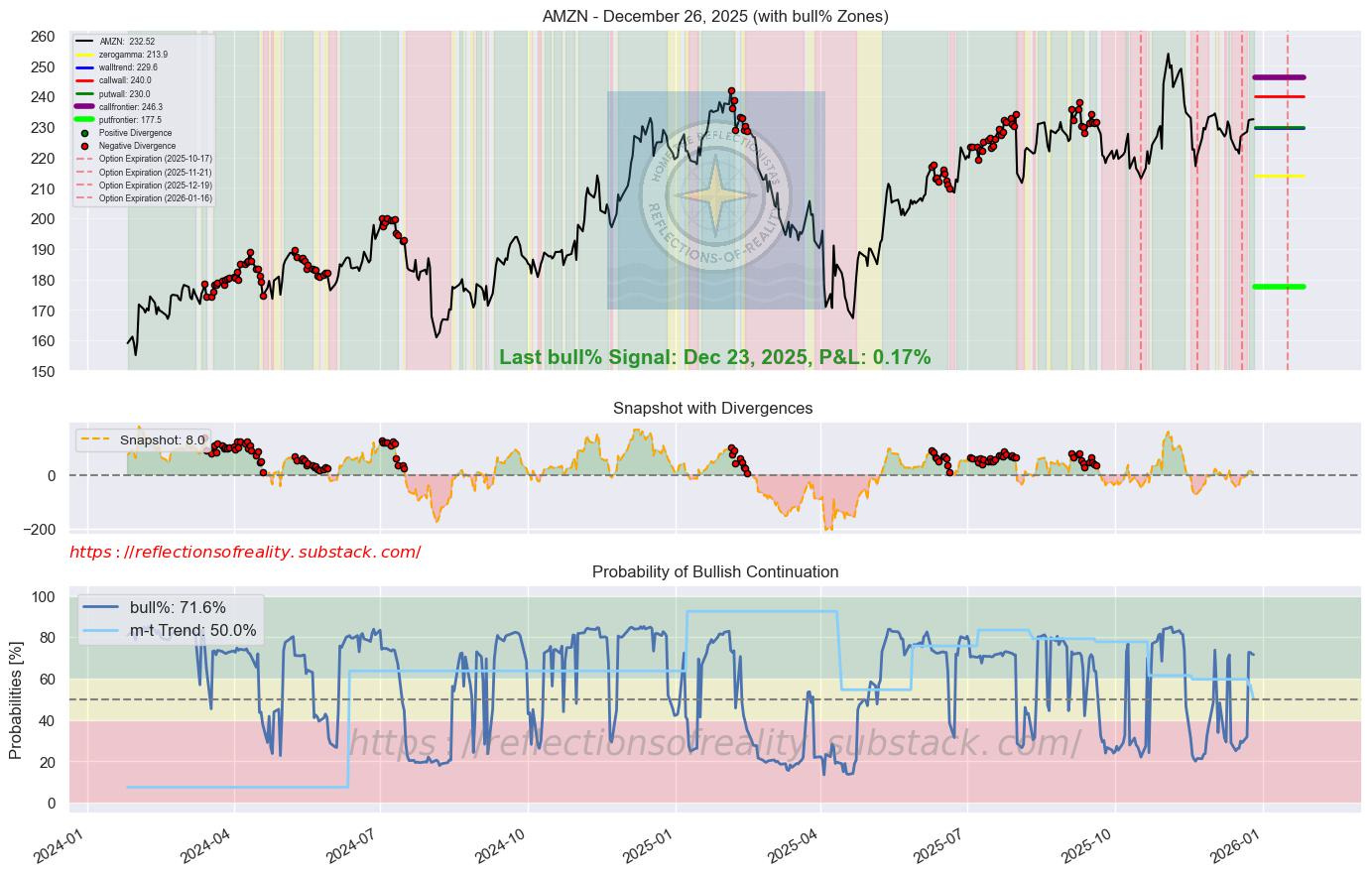

AMZN | 71.6 | -0.3 | [”Beacon1”, “MAGS”] | Amazon is in talks to invest approximately $10 billion in OpenAI, potentially valuing the AI firm over $500 billion. This move would deepen Amazon’s AI capabilities through access to advanced models and chip utilization. It positions AWS for enhanced growth in the competitive cloud and AI infrastructure market. (Reuters, 17 Dec 2025)

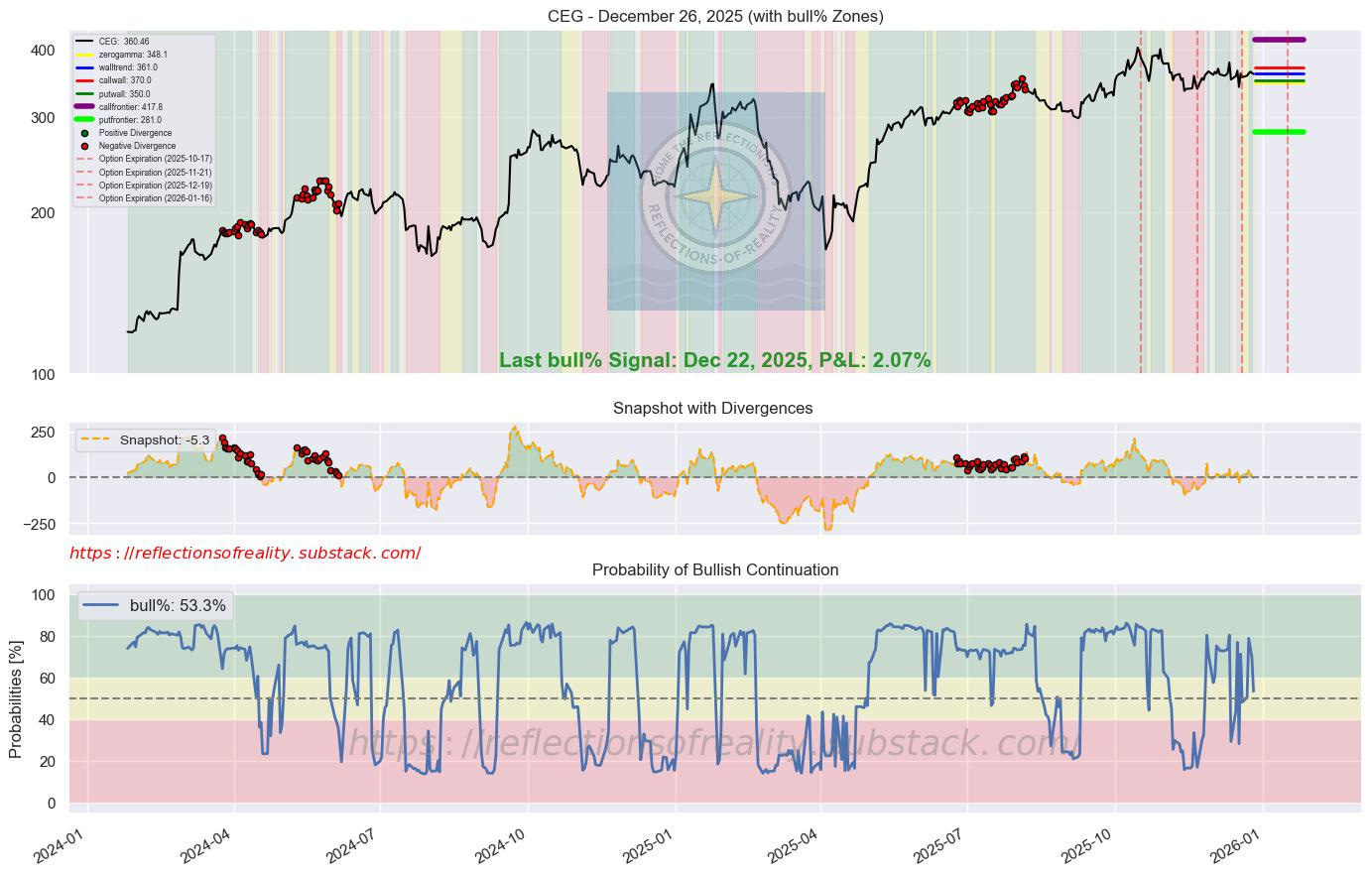

CEG | 53.3 | -16.4 | [’Beacon1’] | Constellation Energy received reaffirmed Buy ratings from analysts including Wells Fargo, citing strong positioning in nuclear power for AI data centers. The company’s clean energy assets benefit from surging electricity demand projections for 2025-2026. This supports potential for elevated valuations amid the AI infrastructure boom. (TipRanks, 22 Dec 2025)

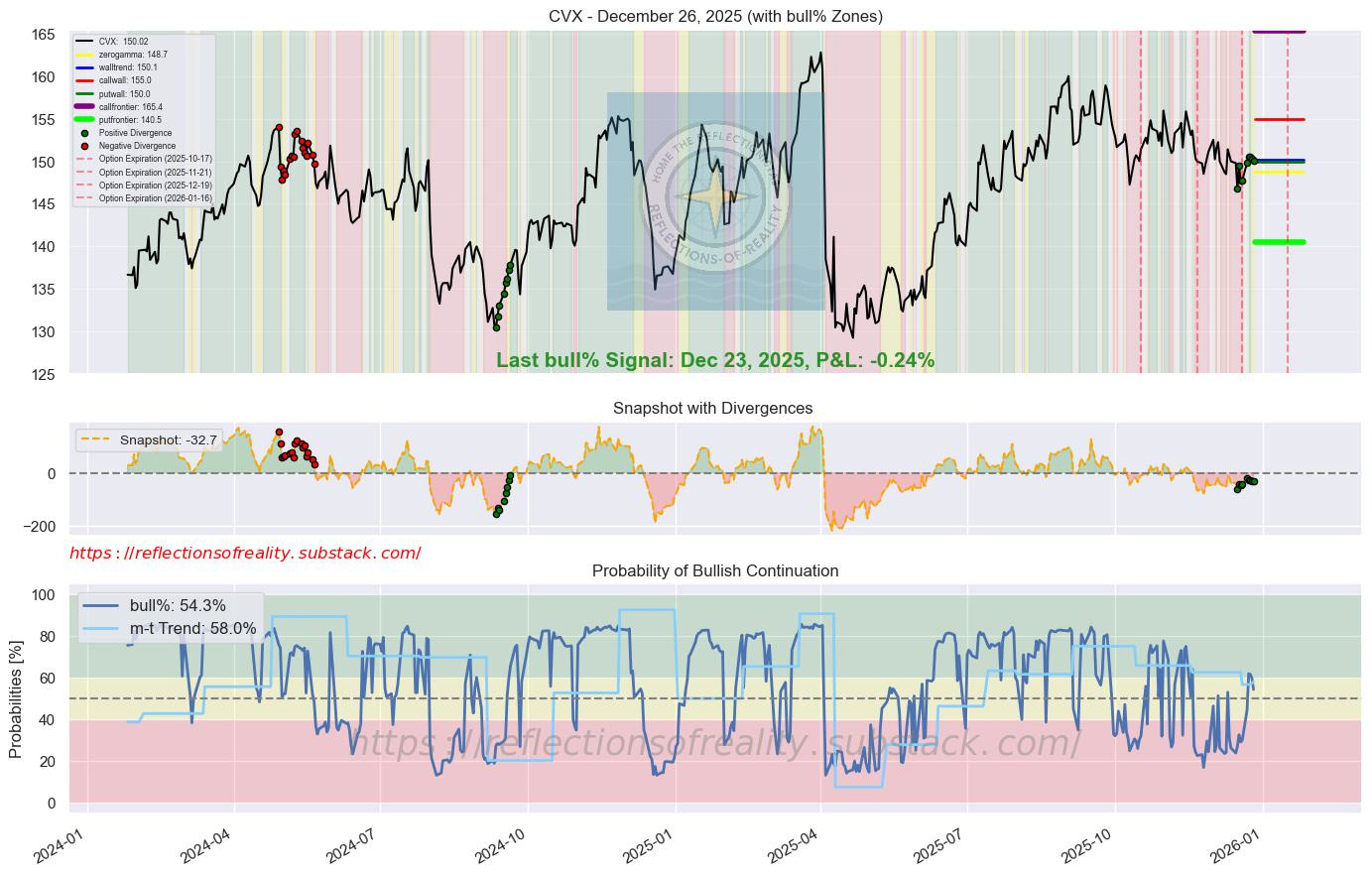

CVX | 54.3 | -5.5 | [’Beacon1’] | Chevron continues operations in Venezuela despite geopolitical risks, maintaining production in key joint ventures. The company’s diversified portfolio and focus on low-cost barrels provide resilience in fluctuating oil markets. Analysts see steady cash flows supporting shareholder returns into 2026. (WSJ/TipRanks, 21 Dec 2025)

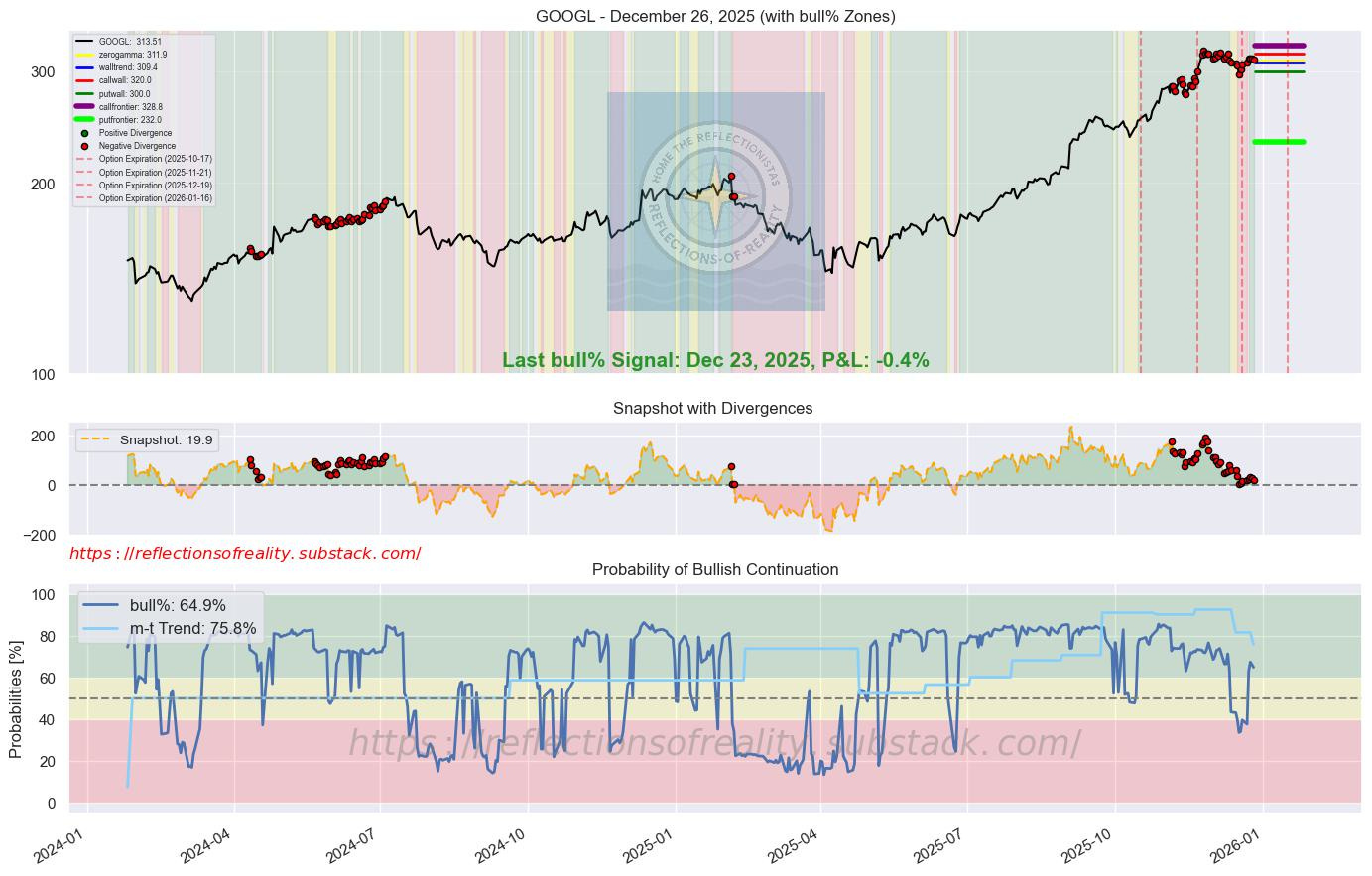

GOOGL | 64.9 | -1.2 | [”Beacon1”, “MAGS”] | Alphabet agreed to acquire data center developer Intersect Power for $4.75 billion to bolster AI infrastructure capacity. The deal enhances Google’s ability to co-locate power generation with hyperscale data centers. It addresses critical energy constraints for continued cloud and AI expansion. (CNBC, 22 Dec 2025)

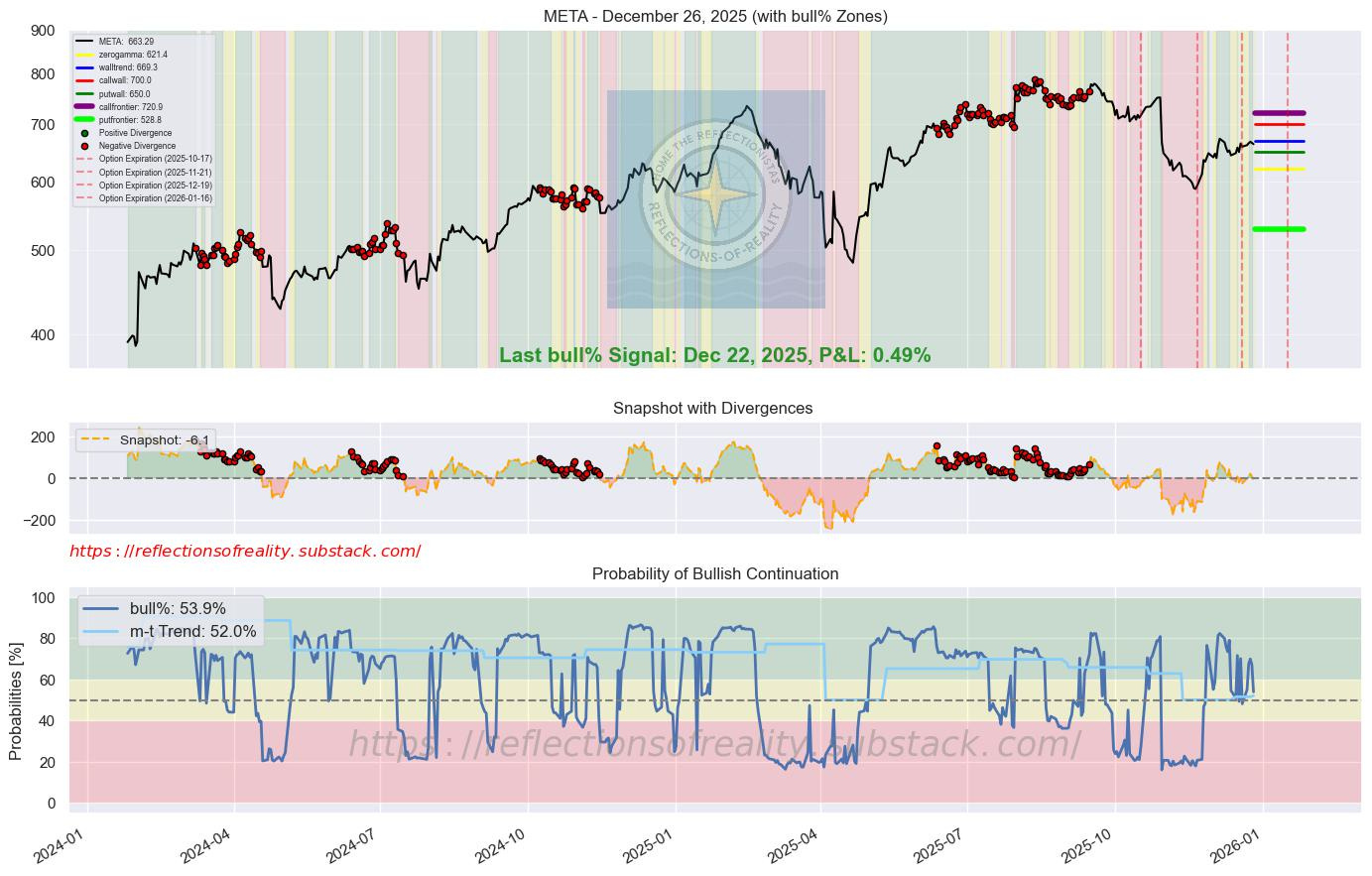

META | 53.9 | -13.1 | [”Beacon1”, “MAGS”] | Meta plans significant budget cuts to its metaverse unit, redirecting resources toward generative AI priorities. Analysts view this as positive for margins and focus on high-growth areas like AI talent and advertising efficiency. The shift supports potential for stock recovery in 2026. (CNBC, 23 Dec 2025)

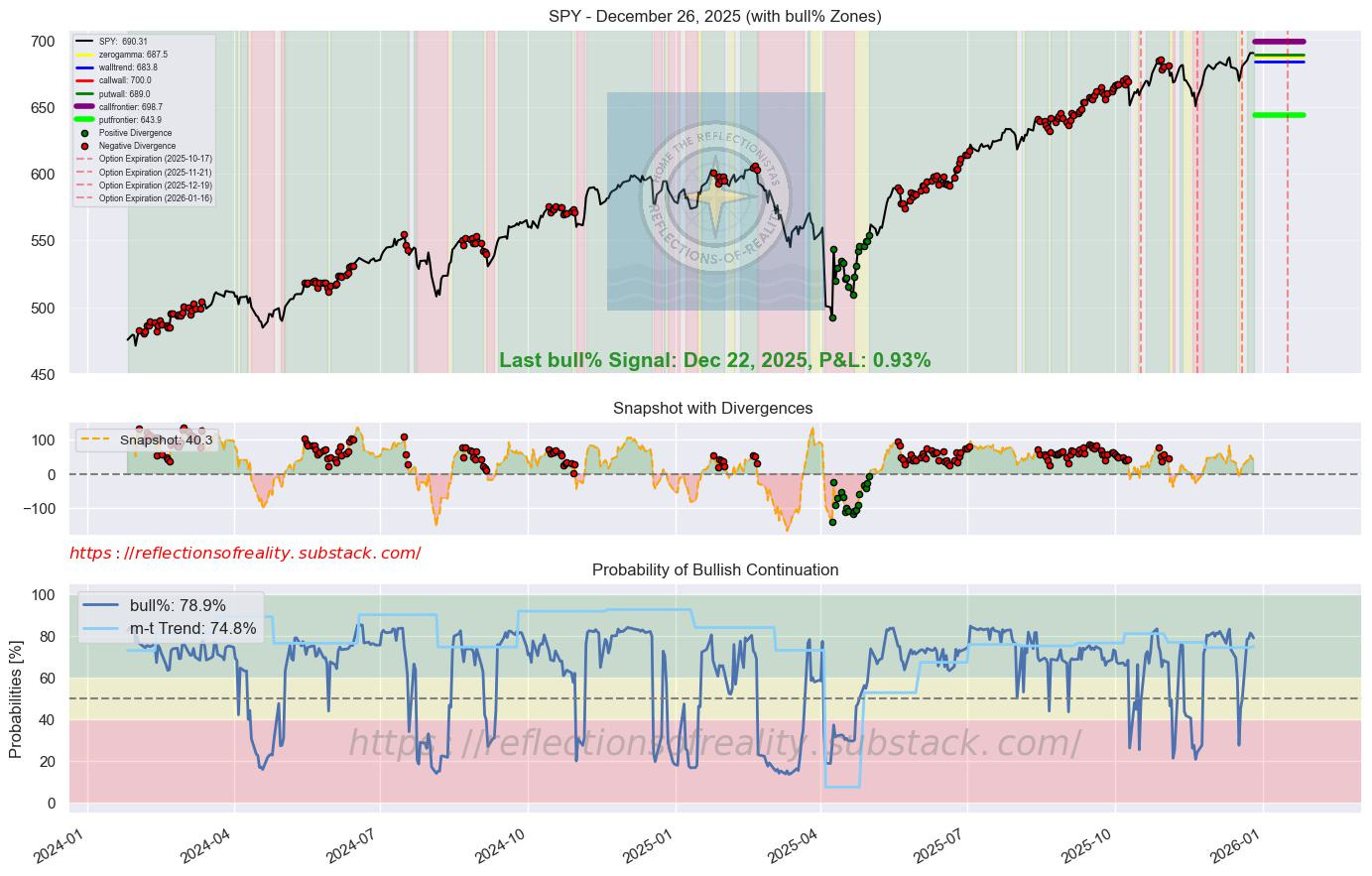

SPY | 78.9 | -1.5 | [’KISS’] | The S&P 500 notched multiple record closes in December amid a broad rally and expectations for continued AI-driven corporate profits. Reduced volatility and seasonal strength contributed to gains despite tariff concerns. Investors anticipate supportive Fed policy sustaining momentum into 2026. (Reuters, 24 Dec 2025)

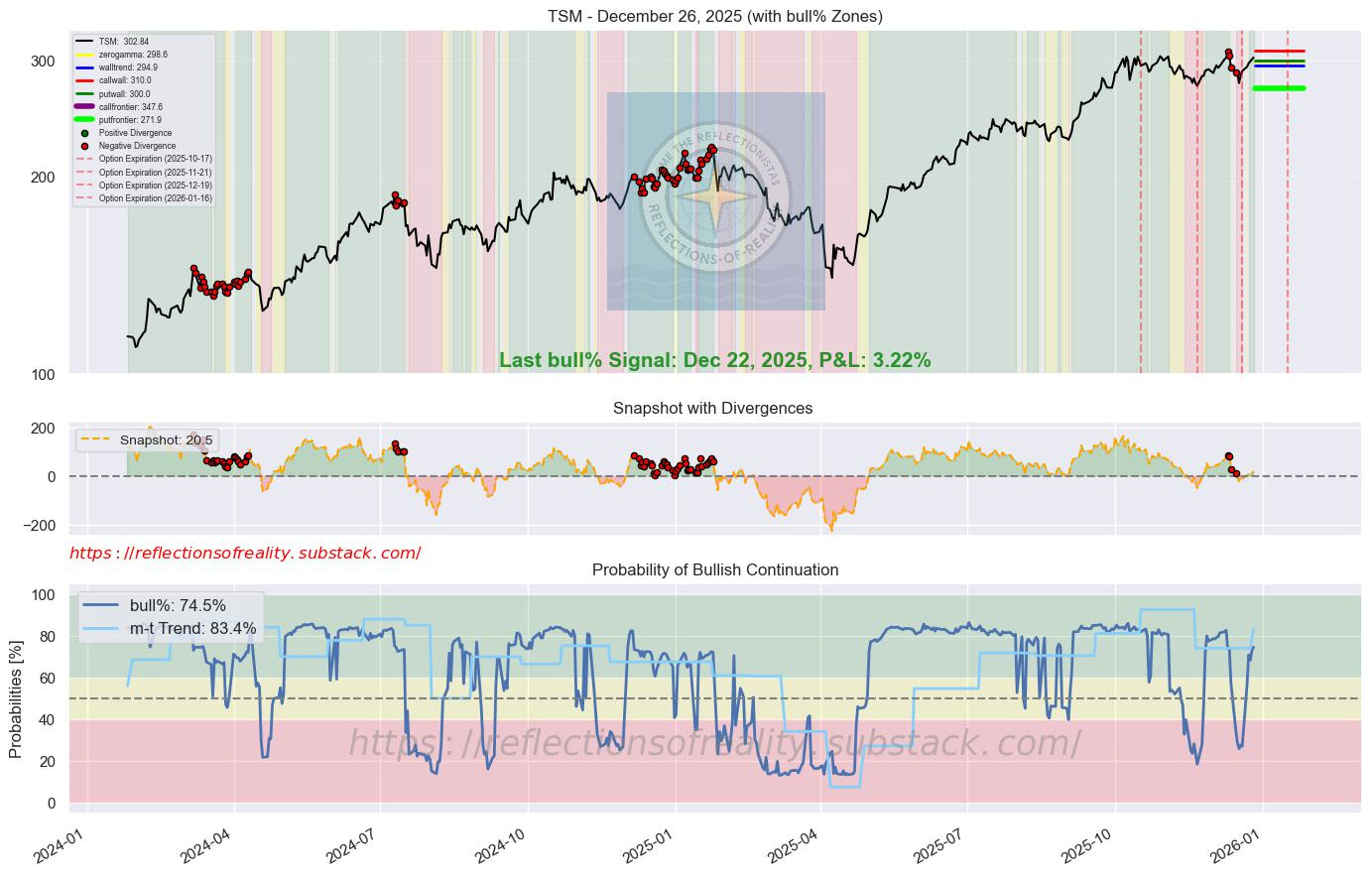

TSM | 74.5 | +1.7 | [’Beacon1’] | Taiwan Semiconductor reported robust capital expenditure approvals and bond issuance, fueling capacity expansion for AI chips. Strong demand from major clients underpins record revenue growth projections. The company’s leading-edge manufacturing dominance positions it for outsized gains in 2026. (TipRanks, 23 Dec 2025)

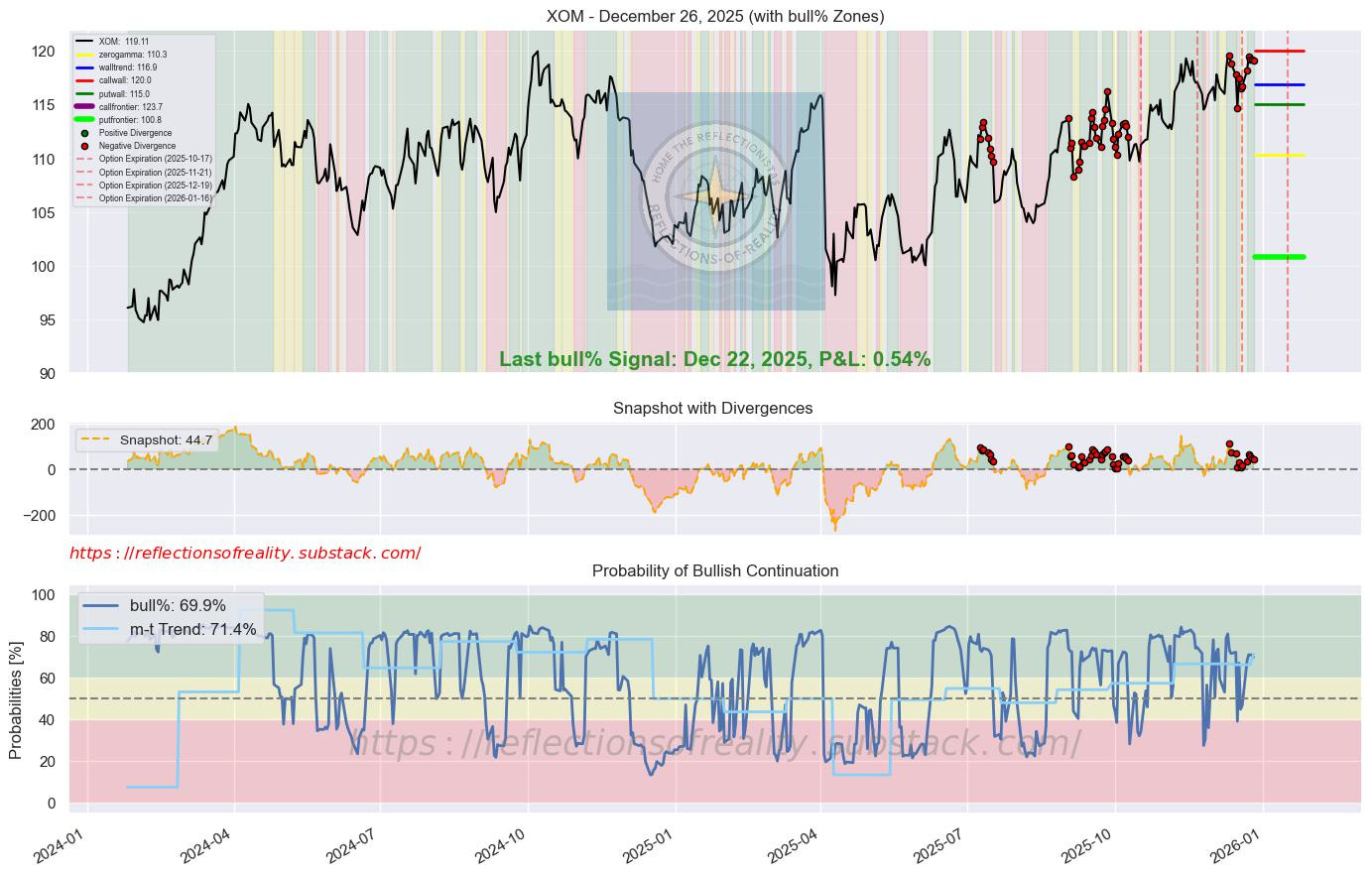

XOM | 69.9 | -1.1 | [’Beacon1’] | Exxon Mobil raised its 2030 earnings growth target to $25 billion, emphasizing low-cost production increases in Guyana and Permian. Disciplined capital allocation supports sustained buybacks and dividends. The updated plan reinforces resilience across oil price cycles. (Reuters, 9 Dec 2025)

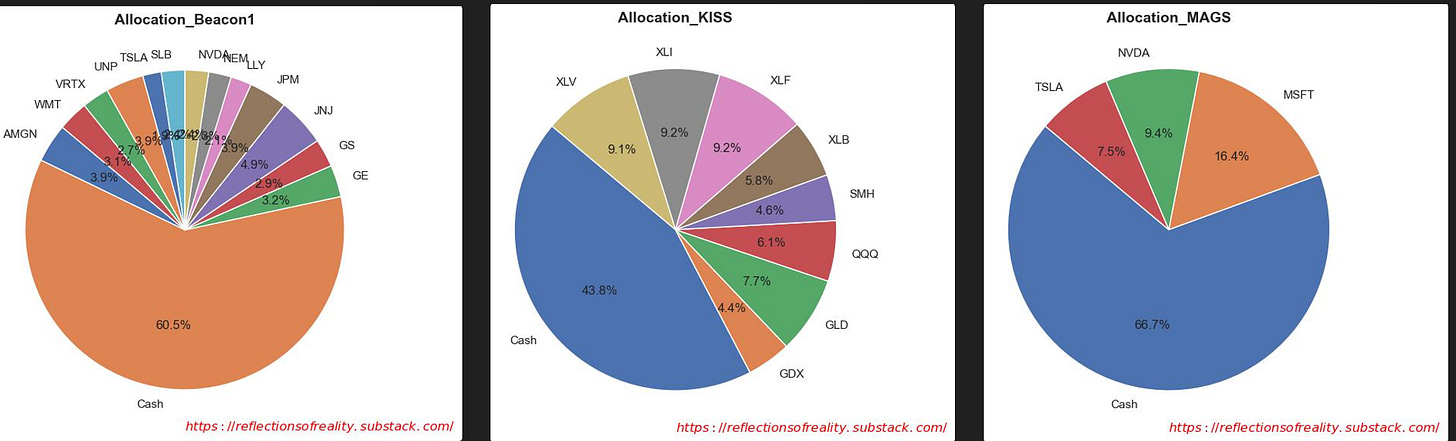

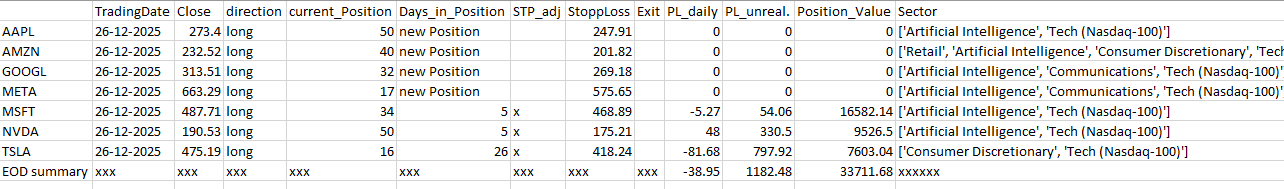

Allocations

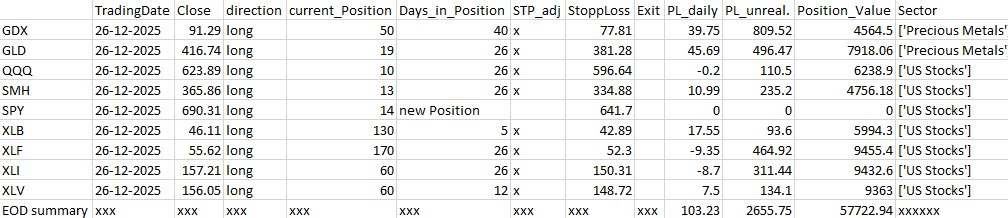

Positions

Beacon1:

KISS:

MAGS: